Nowadays Bitcoin (BTC) price prediction for the nearest future is a tough question. Last year the first cryptocurrency didn’t show us any records in price. However, there are some prediction of Bitcoin 2020 price rise. Will the upcoming halving make the new bitcoin bull run? We’ll see.

How can the currency valued at 5,000 coins per one Papa John’s pizza (on May 22th 2010 Laszlo Hanyecz bought two pizzas for a price of 10,000 BTC) had become the most valuable virtual assets in the world?

In this article, we will answer such questions as:

- Why is Bitcoin going down?

- Will Bitcoin continue to rise?

- How much will Bitcoin be worth in 2020?

- How high can Bitcoin go?

- Will the crypto market recover?

Moreover, we will describe some future projections of bitcoin and learn analysts’ opinion on Bitcoin price changes. Let’s speak a little about the coin’s value today and try to figure out a Bitcoin price prediction for 2020, 2025, 2030, 2040 together with Changelly!

Bitcoin (BTC) Market Data

| BTC Price in USD Today | $9,360.52 |

| Market cap | $170,335,180,488 |

| Circulating supply | 18,197,200 BTC |

| ROI since genesis | 6,818.34% |

| 24-H Trading Volume | $30,988,183,619 |

| All-Time-High | $20,089.00 |

| All-Time-Low | $65.53 |

The above data is valid and relevant as of February 3rd, 2020.

Bitcoin Latest News

#1. Bitcoin could not resist a new high of 2020 after a collapse in Chinese stock exchanges

Bitcoin price updated a new annual high in the early hours of Monday, February 3, soaring at a certain point to the level of $9615. Investors’ expectations for the continuation of the rally did not materialize. Almost immediately the first cryptocurrency fell to levels near $9250.

Buy BTC with USD, EURO or GBP online within minutes. Credit cards accepted. Trade BTC For Ethereum Or Any Other Crypto and get 5% Cashcack On Your Every Trade

The total trading volume of bitcoin futures on the Chicago Mercantile Exchange (CME) since the launch of the product in December 2017 exceeded $100 billion (equivalent to 13.5 million BTC).

The CME Group Exchange launched trading in bitcoin futures in December 2017 a week after the Chicago Options Exchange (CBOE) offered the same product.

Bitcoin (BTC) Historical Price Analysis

We described the entire history of changes in the price of bitcoin from the moment of its creation to this day. You can see Bitcoin (BTC) price prediction below.

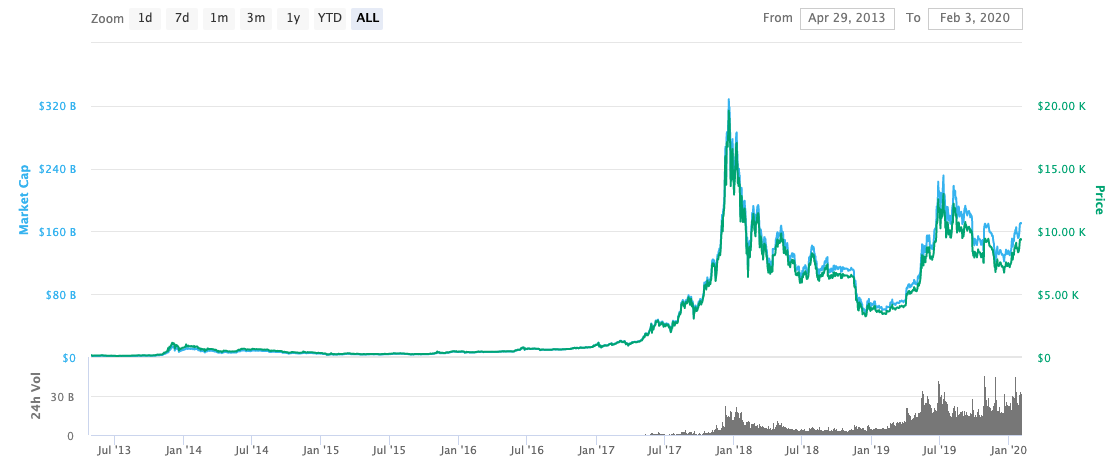

Bitcoin (BTC) Price Graph and Bitcoin History. Source: coinmarketcap.com

At the Dawn of Bitcoin

The events that were saturated in 2010 gave an impetus to the first serious growth of bitcoin. It all started with the launch on February 6 of the BitcoinMarket.com crypto exchange, where 1 bitcoin initially cost $0.003.

This was followed by the first online purchase of a physical product with payment by bitcoins. On May 22, 2010, that same legendary story happened with the purchase of pizza for 10,000 BTC. Jacksonville, Florida resident Laszlo Hanyecz ordered two pizzas from Papa John’s through the Bitcointalk forum, transferring these coins to the user who started the delivery. According to various estimates, at that moment Hanyecz paid only $25–40 for his order.

A truly significant event took place on July 11th. Then Bitcoin was mentioned on the popular news resource Slashdot, which provoked a 10-fold increase in its price over the next 5 days, from $0.008 to $0.08 for 1 BTC.

On the same days (07.17.10), the Mt.Gox exchange was launched, which subsequently was destined to repeatedly have a fatal influence on the cryptocurrency market.

After several months of fluctuation in the range of $0.06–0.07 in early October, the cost of bitcoin began to grow rapidly. Within a month (November 6), the BTC rate reached $0.35 on the Bitcoin Market and $0.5 on Mt.Gox. At this point, bitcoin was worth 16.67 times more expensive than at the beginning of the year, and its capitalization reached $1 million.

BTC Price Fluctuations in 2011-2012

After the rapid growth to $0.5 and the same rapid decline to $0.15, Bitcoin continued to consolidate in the price range of $0.2-0.3 until the beginning of January 2011. Then the rate continues to move upwards and on February 9, 1 BTC at a cost of $1.

This is facilitated by the growing popularity of Bitcoin due to its mention in the Hacker News and Twitter, an increase in the number of miners, as well as the launch of the Darknet site Silk Road, where BTC has become the main payment system.

In mid-April, when an essay was published on Bitcoin in TIME magazine, its course finally breaks the $1 mark and rises upwards so that it will never return to it.

On June 2, 1 BTC was already worth $10. Over the next 6 days, a jerk was made to ~ $32 (June 8). After another 4 days, the exchange rate again fell to $10 and then jumped sharply to $25.

As expected, the increased volatility of bitcoin in the summer of 2011 was accompanied by a negative news background. On June 19, the Mt.Gox crypto exchange was hacked, as a result of which hackers stole and made publicly available data from more than 61 thousand exchange customers.

Despite the relatively small losses, the news about this hack took effect, causing Bitcoin to fluctuate seriously on other exchanges.

Then, in the first week of August, the cost of BTC dropped from $15 to $6. After a quick recovery to $12, the correction of the summer Bull run lasted until November, ending at around $2.5.

For the next year and a half, the price of bitcoin was in the accumulation stage with a gradual increase to $14. The only serious depreciation during this period (from $16 to $7) occurred in August 2012.

Bitcoin in 2013-2016

In mid-January 2013, a new cycle of rapid growth in the cost of bitcoin begins, which reaches its peak on April 11; for $1 BTC is equal to $266.

The new bull run starts at the same level in early November and by the end of the month. The price of bitcoin reaches $1240. This happens against the backdrop of positive news about the acceptance of tuition at one of the universities in Cyprus in bitcoins. Also, the announced support for Bitcoin payments by Zynga, a giant in the field of online game development, has a positive effect.

Started in late 2013, the corrective downward movement of the course became the longest (at that time) in the history of bitcoin. Cryptocurrency winter lasted 411 days until mid-January 2015. During this time, BTC fell 86% from $1240 to $160.

On February 28, the owner of Mt.Gox, Mark Karpeles, announced at a press conference about the bankruptcy of the exchange and the loss of 744.4 thousand customer bitcoins “due to system deficiencies”. At this point, on the exchange itself, the BTC price dropped to $100.

In early January 2015, the Bitstamp crypto exchange announced the hacking and theft of 19 thousand BTC. At this point, the Bitcoin rate drops to $170, but after the resumption of the work of the exchange, it begins to recover, reaching $300 in late January. Then begins a long period of consolidation in the range of $200-300.

In early August, hackers broke into the Bitfinex exchange and stole 120,000 BTC. The price drops below $500 for a short time and then, until the end of October, the exchange rate flies around $600.

Then, by the end of the year, steady growth is observed at up to $1000.

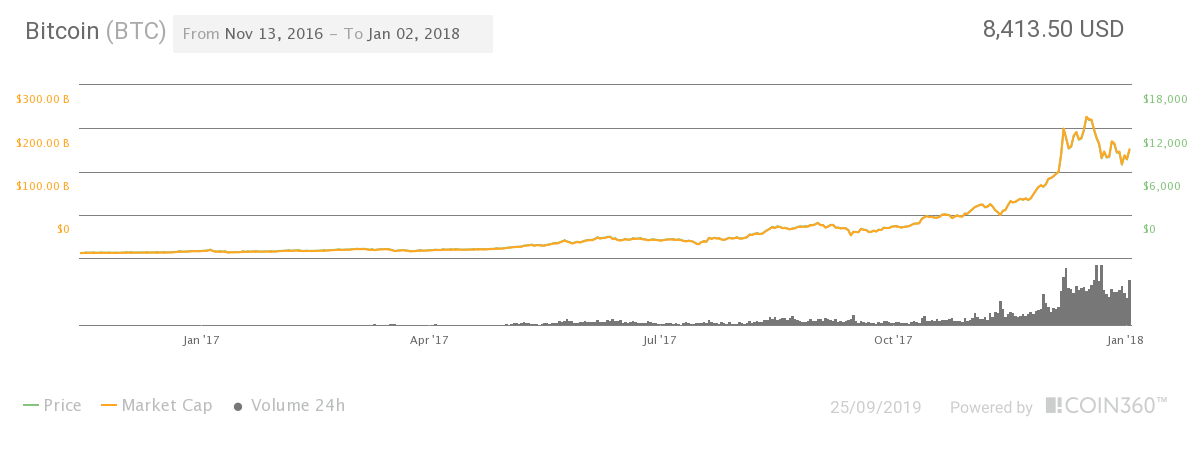

Bitcoin Bull Run in 2017

In early January 2017, the cost of bitcoin for the first time since the end of 2013 reaches $1,150 but then falls to $750 during the week. By mid-March, the course is storming new heights, briefly reaching $1300-1350. By the end of March, the price of BTC drops to $900, but within a month it finally breaks the level of $1350. In the last weeks of May, bitcoin is trading at $2,500-2,600, then adjusted to $1,800, so that in the first decade of June it comes close to $3,000.

The course growth is facilitated by the rapid increase in the number of network users and the recognition of bitcoin as a legal tender by many companies and financial institutions around the world. An important role was also played by the opportunity given to BTC holders to receive Bitcoin Cash (BCH) coins for free as a result of a hard fork on August 1.

Then, on the news of the launch of BTC futures by major US exchanges, almost recoilless rapid growth begins and on December 7, bitcoin is trading at $16,500.

Correction in 2018

Throughout 2018, a correction of the rapid BTC-bull run of 2017 has been observed. The maximum BTC rate in 2018 was a mark of $17,000. The subsequent fall is again accompanied by a fling of negative news from Korea, where authorities have advocated banning the anonymous trading of cryptocurrencies.

The fall in the rate continues until the beginning of February and reaches a minimum of the 6th day ($6000). Unfortunately, the breakdown of the bearish trend does not occur, and from this mark, the exchange rate rises again and drops to $5,800 by the end of June. Over the next 4.5 months, the Bitcoin chart continues to draw a triangle that has already become obvious to many, with a lower face in the region of $6,000.

After a slight rebound, the price continues to move down and on December 15 reaches an annual minimum of $3,200. Then, within 3 days, the price of bitcoin again returns to the region of $4,200.

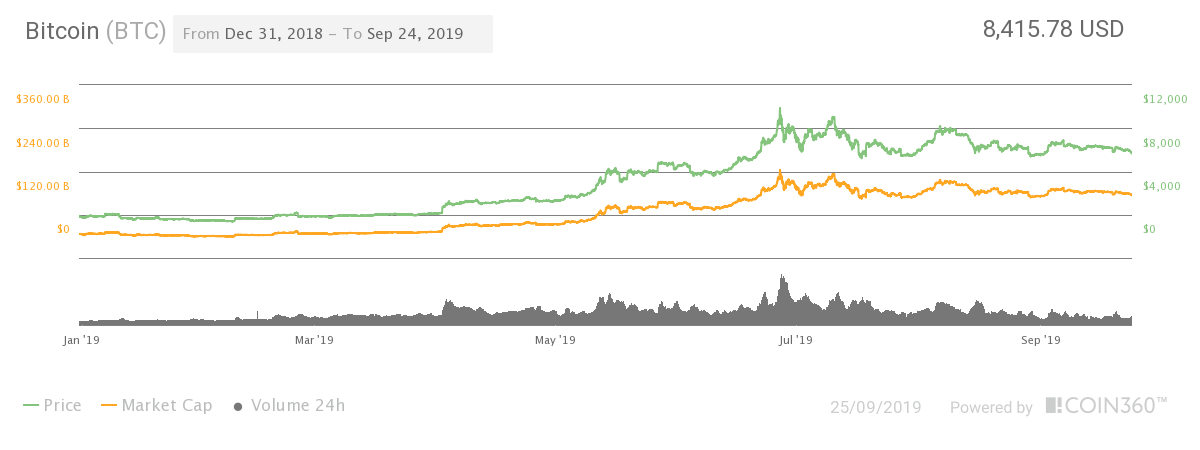

Until the beginning of February 2019, the price continued to move in a downward corridor, for which the resistance becomes the level of $3,300.

On April 2, a breakdown of the level of $4,200 takes place and within a few hours, the price of bitcoin reaches $5,100. Subsequently, the news appears that the reason for this was the purchase by one buyer on several exchanges of 20 thousand bitcoins at once. Many consider this a signal of the return of major players to the market.

The rise of BTC in 2019 happened in June. The highest price was $13,275. The price increase may be due to the launch of bitcoin futures. This type of trading became popular in 2019. Since then, the price of bitcoin has been falling throughout the year.

Bitcoin Technical Analysis

Well, there is not actually any technical analysis expertise of Bitcoin (BTC) cryptocurrency. However, here is the aggregate rating for BTC from several traders & analysts on TradingView.

Bitcoin Bulls & Bears

Undoubtedly, such giants of financial thought like Warren and Joseph Stiglitz are making very dark price predictions for Bitcoin. Nevertheless, a lot of powerful and successful opinion leaders are 100% certain of Bitcoin’s future success.

Here is a resonant post by Barry Silbert that covers the most prominent Bitcoin bulls and bears, which clearly shows there is no lack in support for Bitcoin within the classic business community.

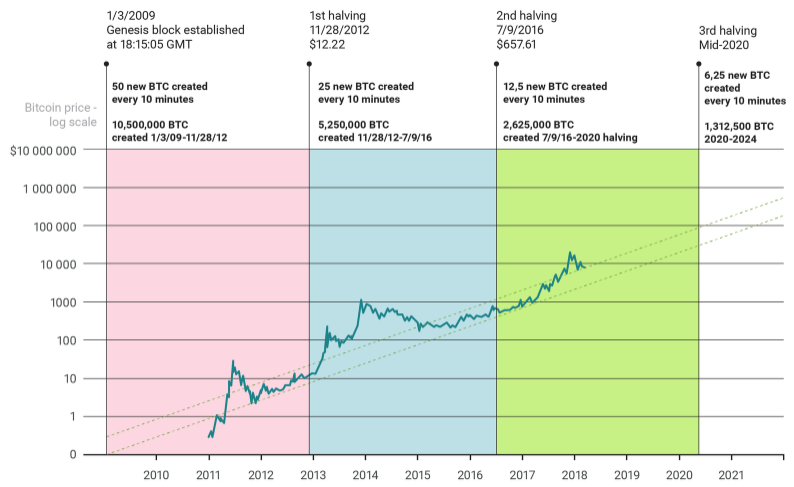

Bitcoin Block Reward Halving 2020 Impact

Can next year halving help us to understand Bitcoin (BTC) Price Prediction? Let’s see.

Reducing rewards and emissions by half affects the number of miners who receive bitcoins for mining blocks. Historically, this process has had a positive impact on the price of the main cryptocurrency in the long term. Bitcoin emission is 21 million coins. Halving is designed to prevent coin inflation. Unlike central banks, which can print cash at their discretion, the number of bitcoins is limited. Thus, cryptocurrency becomes more scarce and valuable.

After two previous halvings, bitcoin rallies took place about a year later. After the first halving in 2012, Bitcoin hit a record high of $1,000 by November 2013. After halving in 2016, Bitcoin took off again and reached its all-time high of $20,089 on December 18, 2017, after which its price fell.

Previously, the block reward was 50 bitcoins, and these coins then cost very little. However, the two previous halvings already reduced the reward twice, and now it amounts to 12.5 bitcoins per block. In 2020, the reward will drop to 6.25 bitcoins.

Halving affects miners. Many people come to the conclusion that the costs of mining, namely electricity and computing power, are not worth less than a reward. However, another part of the miners takes into account the fact that demand is growing as the supply of coins in the world is already approaching their final number, and they do not refuse to mine.

Read about possible scenarios after 2020 and further bitcoin halving in our article.

Bitcoin Market Capitalization Dominance

Just by looking at the indicator of market capitalization, you can understand a lot about cryptocurrency. The first and main conclusion: Bitcoin continues to be the main player in the cryptocurrency market. Its market share is approximately 55%, which is about three times more than that of its closest competitor, Ethereum.

Since its inception, Bitcoin has maintained its leadership in terms of capitalization due to the many positive aspects that occur with cryptocurrency. Developers make important updates that reduce the size of transaction fees, increase network scalability, etc.

An indicator of market capitalization is not just a tool that allows you to quickly assess the value of cryptocurrency. Solid capitalization speaks of the power of a coin.

All about Bitcoin dominance on crypto market is here.

Will Bitcoin Go Up in 2020?

There are several prerequisites for an increase in the price of Bitcoin.

The first important and long-playing factor is market expectations ahead of halving. The second is the positive news background in recent days. Extremely good news comes to us, which could provoke Chinese investors to intensify.

The situation with TON also directly indicates a loan of confidence in the industry from even conservative investors. The appearance of a new cryptocurrency instrument on Bakkt should also have a positive effect.

The third possible factor is the potential impact of large OTC sites. We have repeatedly heard about the plans of many large investors to enter the cryptocurrency market. Especially large deals should expect similar falls with sharp pullbacks after their completion.

Let’s not forget about the unstable political situation. The beginning of 2020 was marked with the escalation of the USA-Iran conflict, which might have had a short-term impact on Bitcoin price (on January 8, BTC price spiked to $8,391). The reaction of the crypto community was like:

Bitcoin (BTC) Price Prediction for 2020, 2025, 2030, 2040

Are you interested in Bitcoin price projections for 2020-2030? Here are all possible long-term BTC price predictions for next years. Find out, if Bitcoin will go back up in 2020-2040.

#1. WalletInvestor Price Prediction for 2020-2025

How high will Bitcoin go? BTC is a very good long-term (1-year) investment. The Bitcoin price can go up from 6702.160 USD to 8386.730 USD in one year. The long-term earning potential is +25.13% in one year. According to present data Bitcoin (BTC) and potentially its market environment has been in a bullish cycle in the last 12 months. There will be a positive trend in the future and the BTC might be good for investing.

- In 2020: $10723.46

- In 2021: $13404.32

- In 2022: $20106.48

- In 2023: $26808.64

- In 2024: $33510.80

- In 2025: $53617.28

#2. CoinPredictor.io BTC Price Predictions for early 2020

Will Bitcoin go up? According to the source, BTC dollar value is going to reduce and reach $7,552.5 by 06/03/2020.

#3. LongForecast Bitcoins Price Predictions 2020-2023

According to LongForecast, Bitcoin will cost will vary in the range between $6871-9757 in January. Throughout 2020, BTC price will fluctuate and reach $9,306 by December 2020. In the next year, the coin price will decrease again and cost as low as only $5032.

- In 2021: $4,935-5,032

- In 2022: $11,107-12,884

- In 2023: $22,390- 25,972

#4. DigitalCoinPrice Predictions for 2020-2025

DigitalCoinPrice’s forecast for December 2019 ($17,239.27) clearly did not materialize. Yet, it provides a lot of positive BTC price predictions for 2020 and further:

- In 2020: $17,770.67

- In 2021: $20,112.19

- In 2022: $24,444.14

- In 2023: $26,137.76

- In 2024: $18,053.73

- In 2025: $17,872.83

- In 2026: $12,713.82

#5. Bitcoin Jack Price Prediction

Will Bitcoin recover? An analyst with the nickname Bitcoin Jack believes that BTC could fall to $7400, but the weakening will be short-lived. As soon as the largest digital currency touches the new “bottom”, a breakthrough will begin almost immediately.

#6. Roger Ver Bitcoin Price Prediction

Here are Bitcoin price projections by Roger Ver. In October 2015, Roger Ver said that bitcoin can worth $2,500, $25,000, or even $250,000 per one coin. According to his words, this cryptocurrency has great potential.

#7. Winklevoss Brothers’ BTC Price Prediction

Tyler Winklevoss claims that Bitcoin is a version of gold 2.0. He also says that Bitcoin is better than gold just because it’s portable and devisable.

#8. Vinny Lingham Price Forecast of Bitcoin

Vinny Lingham, a co-founder of Civic, claims that Bitcoin’s price can range from $100,000 to $1M by 2030.

#9. Tim Draper BTC Price Prediction for 2022

Will Bitcoin keep rising? A billion investor, Tim Draper says that Bitcoin will hit $250,000 by 2022. According to his words, people would be able to buy coffee for bitcoins in 2021.

#10. Anthony Pompliano Talks About Bitcoin Future Price

Anthony Pompliano has shared his opinion on Bitcoin future. He thinks that the rise of the cryptocurrency price has stopped. People should be ready that the bitcoin cost may reach the dip of $3 thousand. Pompliano is sure that while the declining price Bitcoin becomes stronger.

#11. John McAfee’s Price Prediction of Bitcoin

Bitcoin is a real shitcoin, said McAfee antivirus creator John McAfee. In his Twitter account, he wrote that the future lies with altcoins, since they bypass the first cryptocurrency in technical specifications.

Earlier, he abandoned his $1 million forecast for Bitcoin, calling it a trick to attract new users.

#12. Stephen Perrenod’s BTC Price Prediction

Analyst Stephen Perrenod believes that the assumption of a multiple increase in the price of the first cryptocurrency takes place.

In his blog, the expert proposed a new model for calculating the future Bitcoin exchange rate. Unlike the previous ones, it takes into account not only the shortage of coins that will arise due to the limited issue and halving but also their residual supply.

Based on this, the analyst concluded that, with constant demand, Bitcoin will rise in price against the background of diminishing inflation and rise in price to $77,500 within a decade. However, this figure may increase significantly, possibly even up to $100,000 if the value of the US dollar decreases, Perrenod added.

#13. Mike Novogratz on Bitcoin Value

In an interview with Blomberg, Galaxy Digital founder and CEO Mike Novogratz called Bitcoin digital gold and a self-defense weapon in the investor’s portfolio.

According to him, the growth of liquidity in the US economy undermines confidence in the dollar and creates the conditions under which people realize the need for Bitcoin.

Political tensions between the US and Iran and the outbreak of coronavirus in China also contribute to Bitcoin investments. At the same time, the leading cryptocurrency has proven that it can be considered a reliable alternative, the former Goldman Sachs partner emphasized.

Bitcoin is a type of gold. We call it digital gold and set up the infrastructure for the entire system to allow more and more people to buy bitcoin, as it is being traded more and more.Mike Novogratz

F.A.Q. about Bitcoin Price

Here is our small F.A.Q. regarding the Bitcoin price fluctuations.

Will Bitcoin go back to the Dec’17 price level?

How low will Bitcoin go? According to leading cryptanalysts, bitcoin will gain momentum after halving in 2020.

The Bitcoin exchange rate will increase by 500% in the next 10 months due to the upcoming cryptocurrency halving in 2020, according to Joe Kernen, the host of the Squawk Box program on CNBC. In May 2020, the value of the coin will reach $55,000 due to the mechanism for changing the dynamics of supply and demand, which is embedded in the asset blockchain.

Morgan Creek Digital founder and partner Anthony Pompliano suggested that halving the first cryptocurrency will positively affect its growth in the next 12-18 months.

Where is Bitcoin going as a project?

Bitcoin is developing right now in those areas in which it has real prospects, namely:

- Every day the number of projects accepting Bitcoin as a means of payment is growing. Bitcoin transactions help to avoid blocking funds bypassing traditional financial institutions.

- Bitcoin provides opportunities similar to banking services. In some regions, people already have access to bitcoin ATMs, where you can withdraw funds from your wallet or transfer them to a bitcoin card. Such cards can be an alternative to debit bank cards.

- Bitcoin is a turnkey solution for those who do not want or cannot use fiat currency, who have lost faith in central banks, live in a country with a degrading economy, or in a region where there is no stable currency.

Will BTC go down soon?

Bitcoin is still in the red zone (as of October 17, 2019). During the day, its average market value decreased by 2.01%, to $8024. Most of the largest altcoins by capitalization also show a depreciation.

After touching $8,391 level, BTC price has quickly returned to $7K position. Bitcoin needs something to trigger further growth.

We hope for a successful outcome in connection with halving. Closer to a certain date, the price of bitcoin should rise and reach for the entire cryptocurrency market.

Is Bitcoin a financial bubble?

Well-known economists often called bitcoin a speculative bubble. In particular, the American economist, the former head of the Fed, Alan Greenspan called bitcoin a bubble without inherent currency value. Nobel laureate, economist, Robert Schiller claims that bitcoin shows many similar characteristics to the economic bubble.

Journalist Matthew Boesler refuted the prevailing opinion in the society and said that the rapid growth of bitcoin is due to normal economic processes. Journalist Timothy B. Lee wrote in a note to the Washington Post that a sharp rise and fall in prices is not a definition of an economic bubble.

Final Words & Price Expectation

Bitcoin is an asset that should start to exist outside of its current “speculative gains” framework. It is understandable that people seek to make a promising investment and Bitcoin looks like a great choice for it.

Obviously, Bitcoin has come a long way since its invention back in 2009. However, even though it has emerged as a popular alternative to fiat all over the world with regulators slowly but surely yielding to the crypto revolution, there is still much to be done for full adoption to be achieved. At the moment, whether Bitcoin’s price hits new levels in the future is still a tall prediction. We expect the rate increase in the nearest future due to the upcoming halving.

Bitcoin is not only a price graph – it is a new type of money that is available for anyone and operates free from the government borders and regulations. You better try to find out how it can be useful for your particular needs and invest in accordance with these factors.

Buy BTC at the Best Rate

Any investor should research multiple viewpoints and be familiar with all local regulations before committing to an investment. Website personnel and the author of this article may have holdings in the above-mentioned cryptocurrencies.

Comments

Post a Comment